April 2025

As we entered 2025, American exceptionalism emerged as a prominent topic. However, the dramatic outperformance of international stocks vs. U.S. stocks (MSCI EAFE vs. S&P 500) and value stocks vs. growth stocks (MSCI World Value vs. MSCI World Growth) in the first quarter of 20251 reminded us again that when market sentiment is extremely negative, it often doesn’t take much for the pendulum to swing. While we cannot predict if this pattern will continue, we believe that international and value stocks offer compelling return potential based on their current valuation levels.

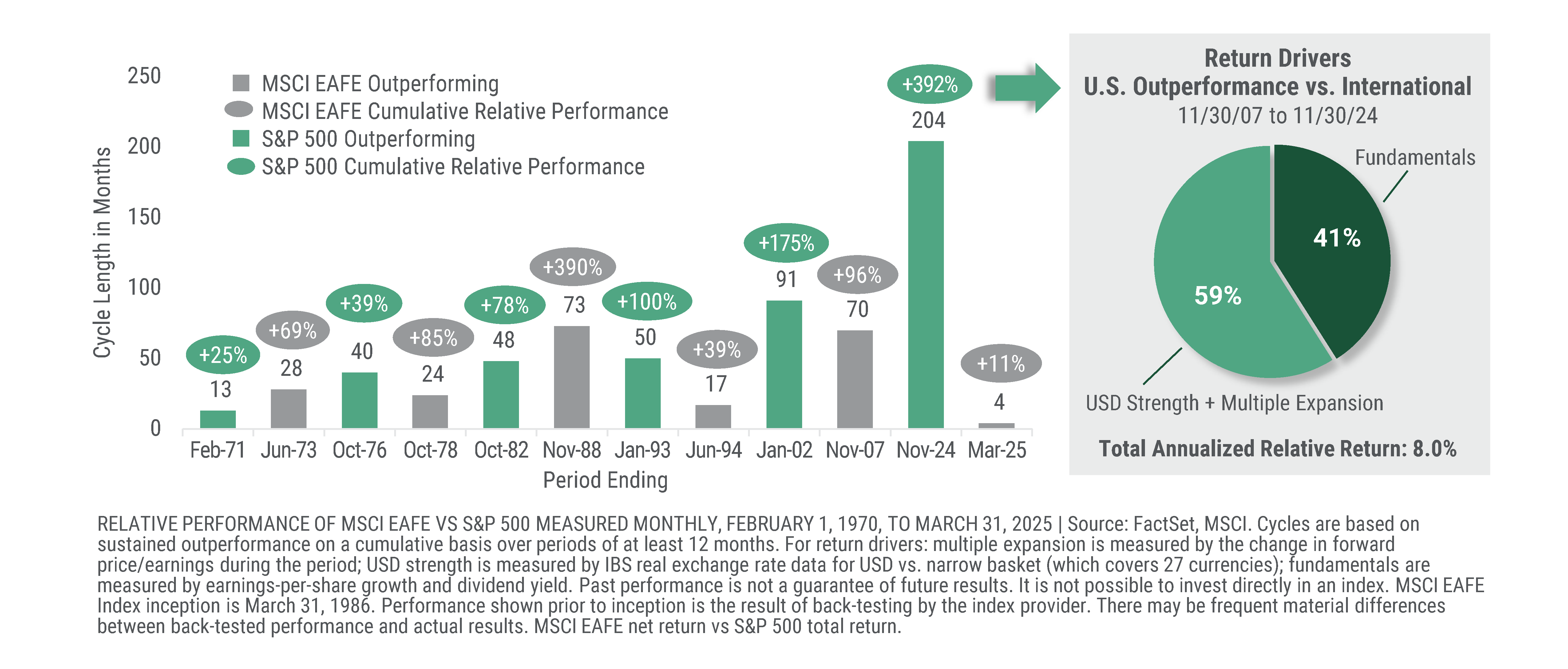

After a prolonged period of underperformance, it is not surprising that there had been little demand to invest in non-U.S. equities, with many investors seemingly thinking that a reversal may never happen. However, history has shown that markets did cycle, and these cycles—although not consistent—tended to last quite a while.

Interestingly, the most recent U.S.-led cycle was only partly shaped by company fundamentals. A strong U.S. dollar and lofty investor enthusiasm driving up valuations (i.e., “multiple expansion”) also played a big role. These two factors powered approximately 4.7% annualized of U.S. outperformance (representing 59% of outperformance) versus international markets since late 2007, but we believe they are less likely to continue going forward.

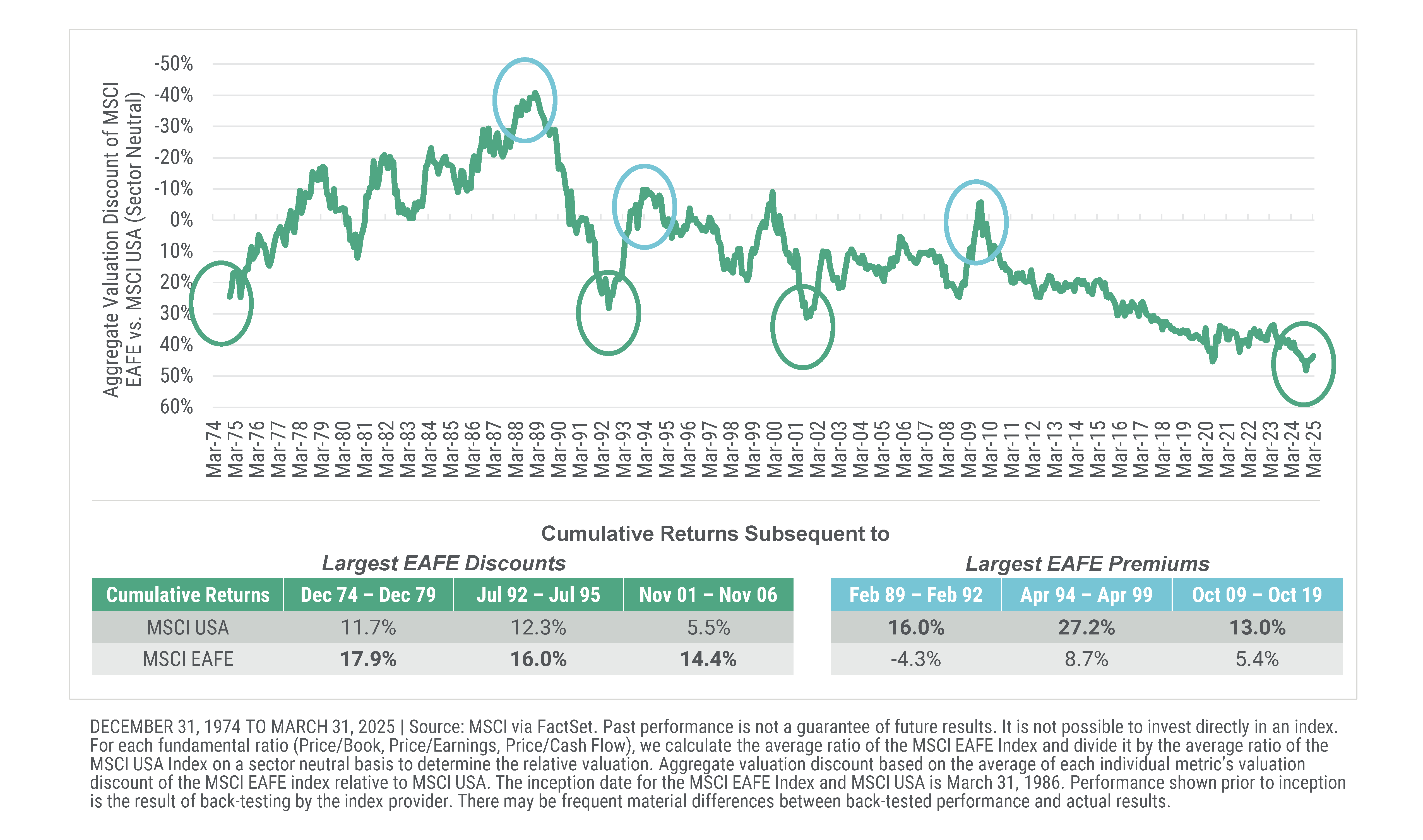

Following the outperformance of international stocks in the first quarter, valuations for U.S. equities remain elevated. On a sector-adjusted basis, international stocks continue to trade near some of the largest valuation discounts versus U.S. stocks. Historically, such valuation discounts have often preceded appealing returns for international stocks relative to their U.S. counterparts.

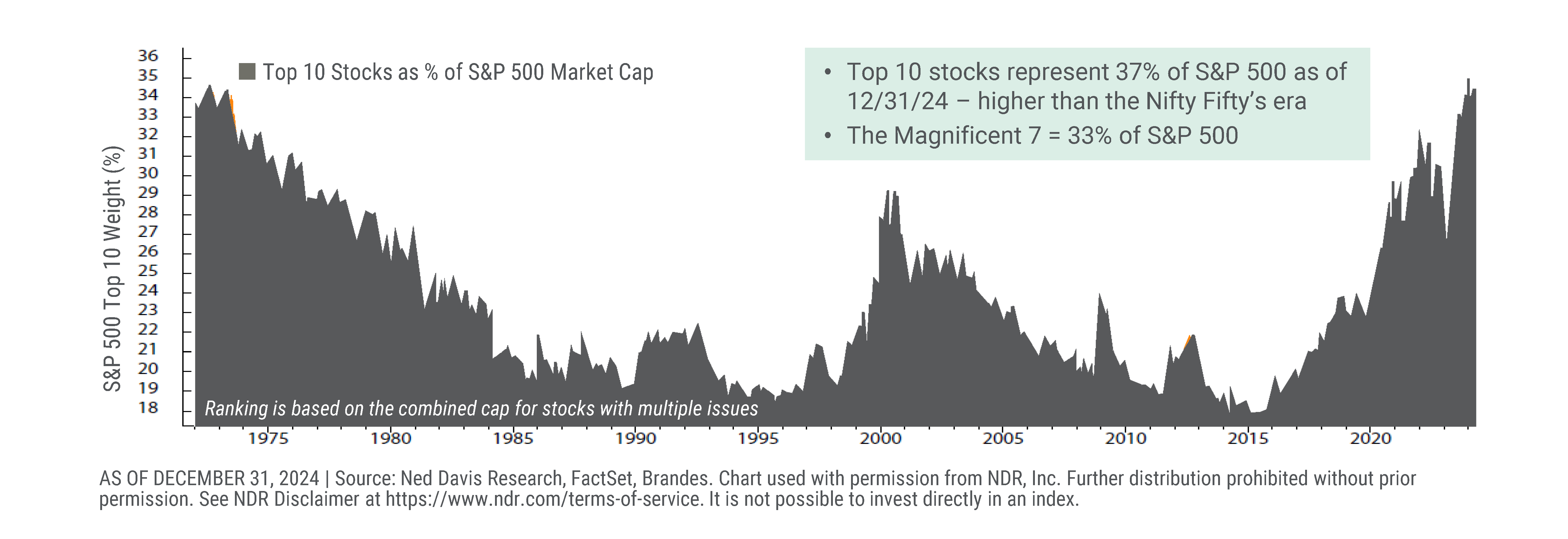

The dominance of the U.S. market has led many investors to become overexposed to U.S. equities—and to growth stocks, as the largest allocations in the U.S. market (S&P 500) consist of predominantly growth companies, many of them tech-related.

Predicting when the tide may turn or when market negativity may peak is impossible. Thus, we believe the recent market shifts serve as a crucial reminder of the importance of diversification, and why international equities and value stocks should consistently be part of a diversified equity portfolio.

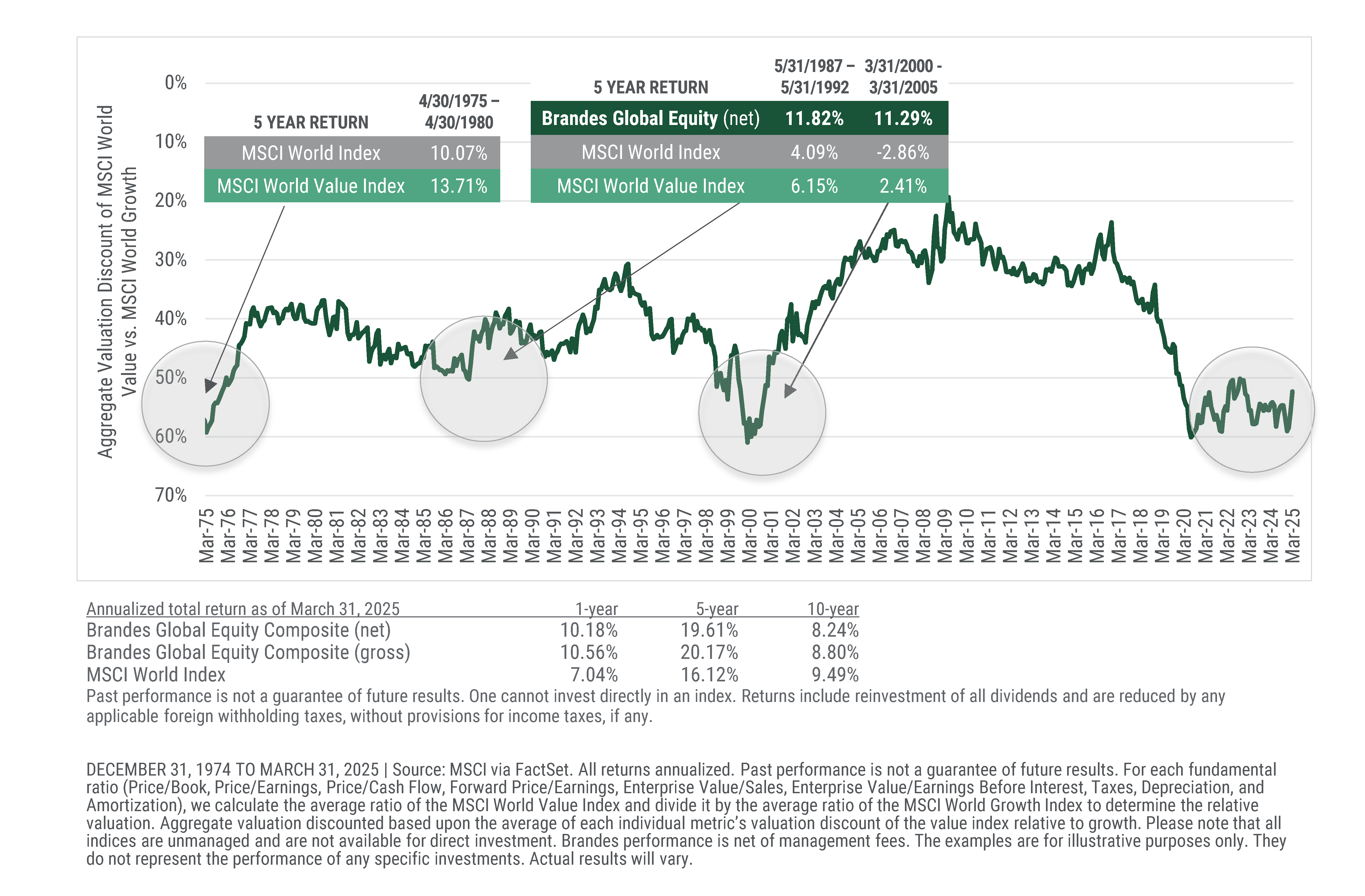

Similar to international vs. U.S. stocks, value stocks’ outperformance relative to growth stocks in the first quarter of 2025 has done little to narrow the valuation gap between the two asset classes. Value stocks continue to trade among the cheapest quartile relative to growth stocks (MSCI World Value vs. MSCI World Growth) across various valuation measures. We believe this should bode well for value stocks in general and our Brandes Global Equity Strategy in particular, as the strategy has had the tendency to outperform the benchmark (MSCI World) during value-led periods.

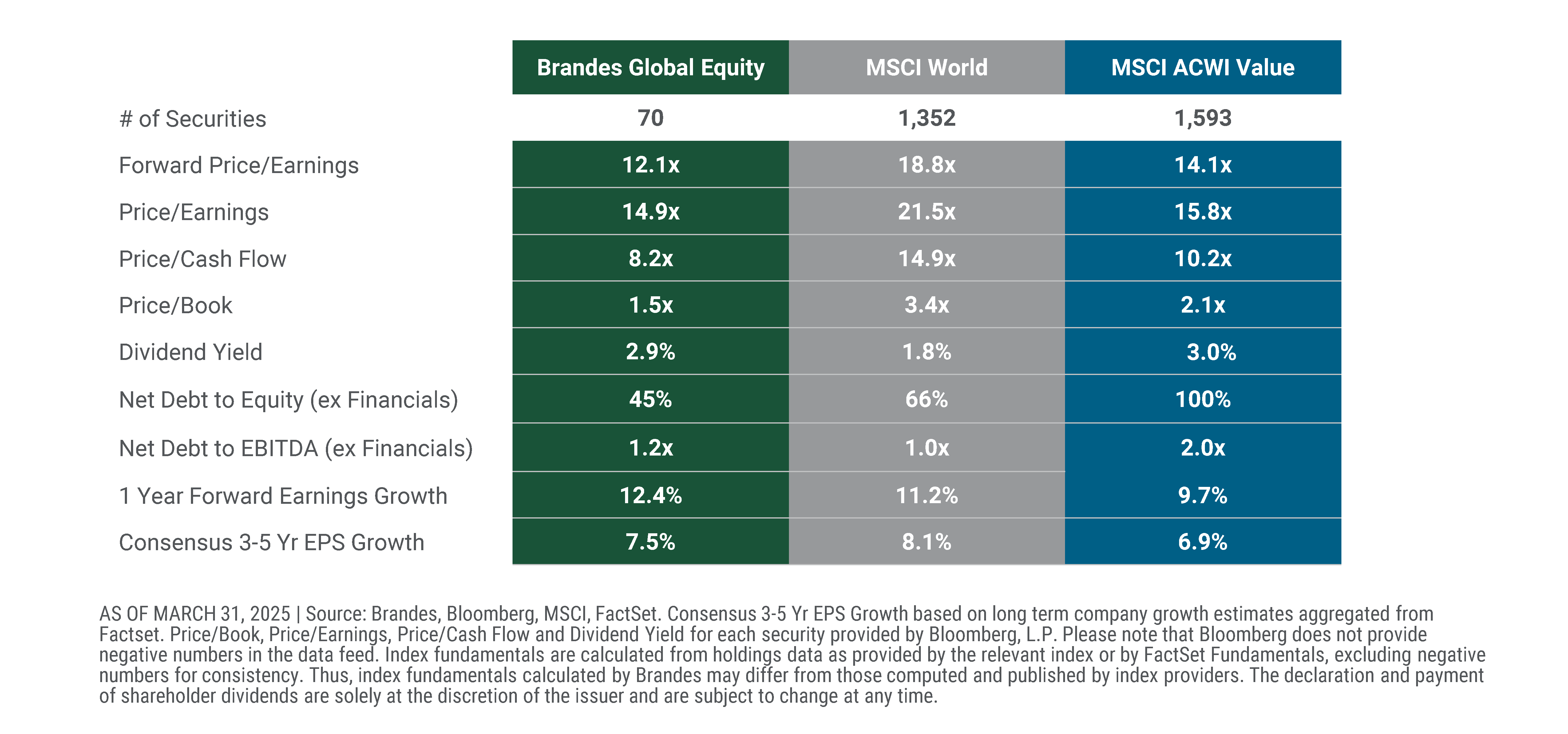

As of March 31, 2025, the Brandes Global Equity Strategy trades at what we consider more compelling valuation levels than the benchmark, and our holdings in aggregate have stronger balance sheets than the companies that comprise the MSCI World and MSCI World Value indices.

With fifty years in business, we have learned that uncertainty is an enduring feature of markets. While unease seems heightened today compared to much of the past 15 years, it is prudent to remember that markets evolve over time and good businesses have the ability to adapt to new environments, highlighting the need to discriminate among opportunities.

The impact and duration of the recently announced tariffs will likely vary by industry or company. With our fundamental and research-focused investing approach, we believe we are well positioned to take advantage of potential market over- and underreactions to the changing environment.