Many investors struggle with managing their emotions when it comes to investment decisions. Behavioral finance—the science of decision-making as it applies to investment decisions—has many practical applications to help “train the investor brain” and dispel common investor misperceptions. Applying behavioral finance concepts may help you increase the odds of reaching—or exceeding—your investment goals.

How do you perceive risk? Contrary to popular belief, the relationship between risk and return is not linear. Higher risk may bring higher returns – but it may also bring big losses.

How do we make investing less stressful? A solution is to make a plan—An Investor Stress Management Plan or "ISMAP." The ISMAP is designed to prepare investors for inevitable scary moments and provide techniques to reduce that stress to a manageable level. It contains actions that can help take advantage of market turmoil to actually improve long-term performance.

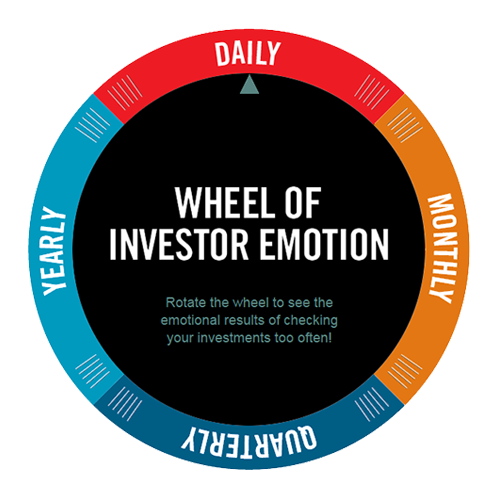

Do you find yourself constantly checking your portfolio returns and perhaps losing sleep during inevitable down markets?

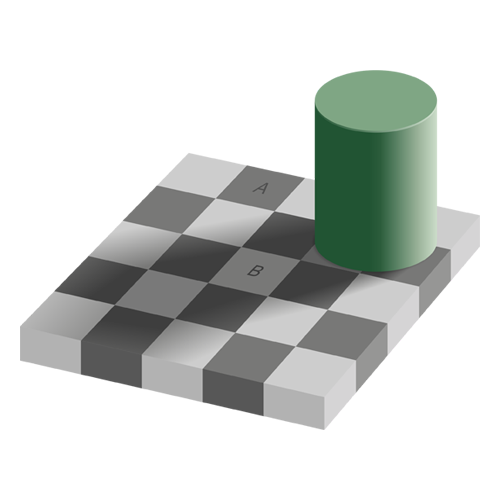

The checkerboard optical illusion illustrates an example of “heuristics,” or mental shortcuts that our brains use to answer questions or make decisions.