Dear Clients and Friends,

Having been in the asset management business for over half a century, we’ve observed several notable market phenomena, one of which is that investment styles tend to cycle in and out of favor. The duration of each cycle may vary and the catalysts for shifts in style leadership can be unpredictable, but as the famous quote often attributed to Mark Twain says: “History doesn’t repeat itself, but it often rhymes.” Indeed, over the past 50 years, we’ve seen investment styles fall in and out of favor numerous times.

In our opinion, the cyclicality of investment styles underscores the importance of diversification. In this letter, we explore how the Brandes International Equity Strategy could influence the risk and return profile of a diversified portfolio across various cycles. To illustrate this, we created a hypothetical equal-weighted portfolio consisting of the MSCI EAFE Growth Index, the MSCI ACWI ex USA Quality Index, and the MSCI EAFE Momentum Index. We then added the Brandes International Equity Strategy to this portfolio (allocating 25% to each component) to compare its risk and return profiles before and after the addition.

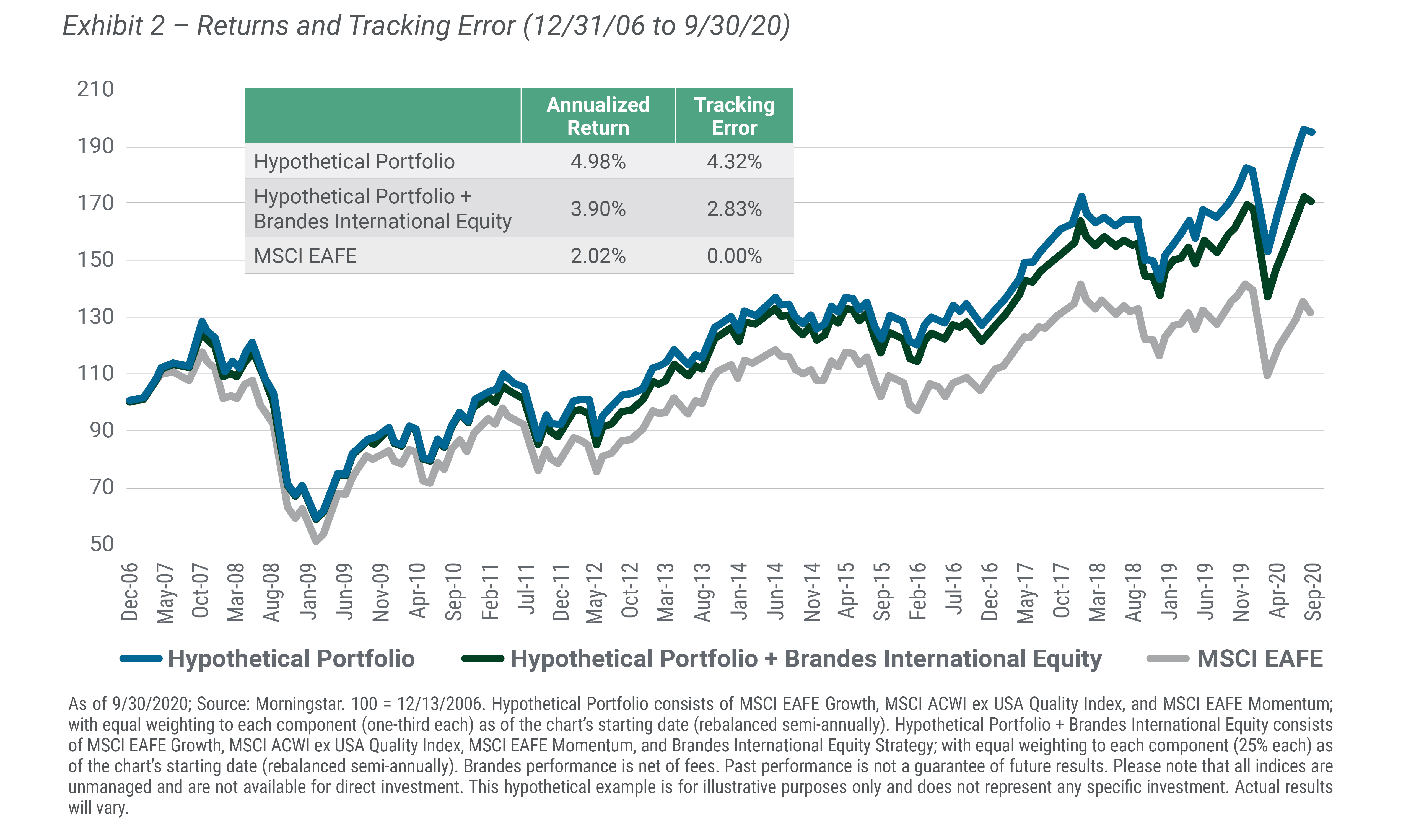

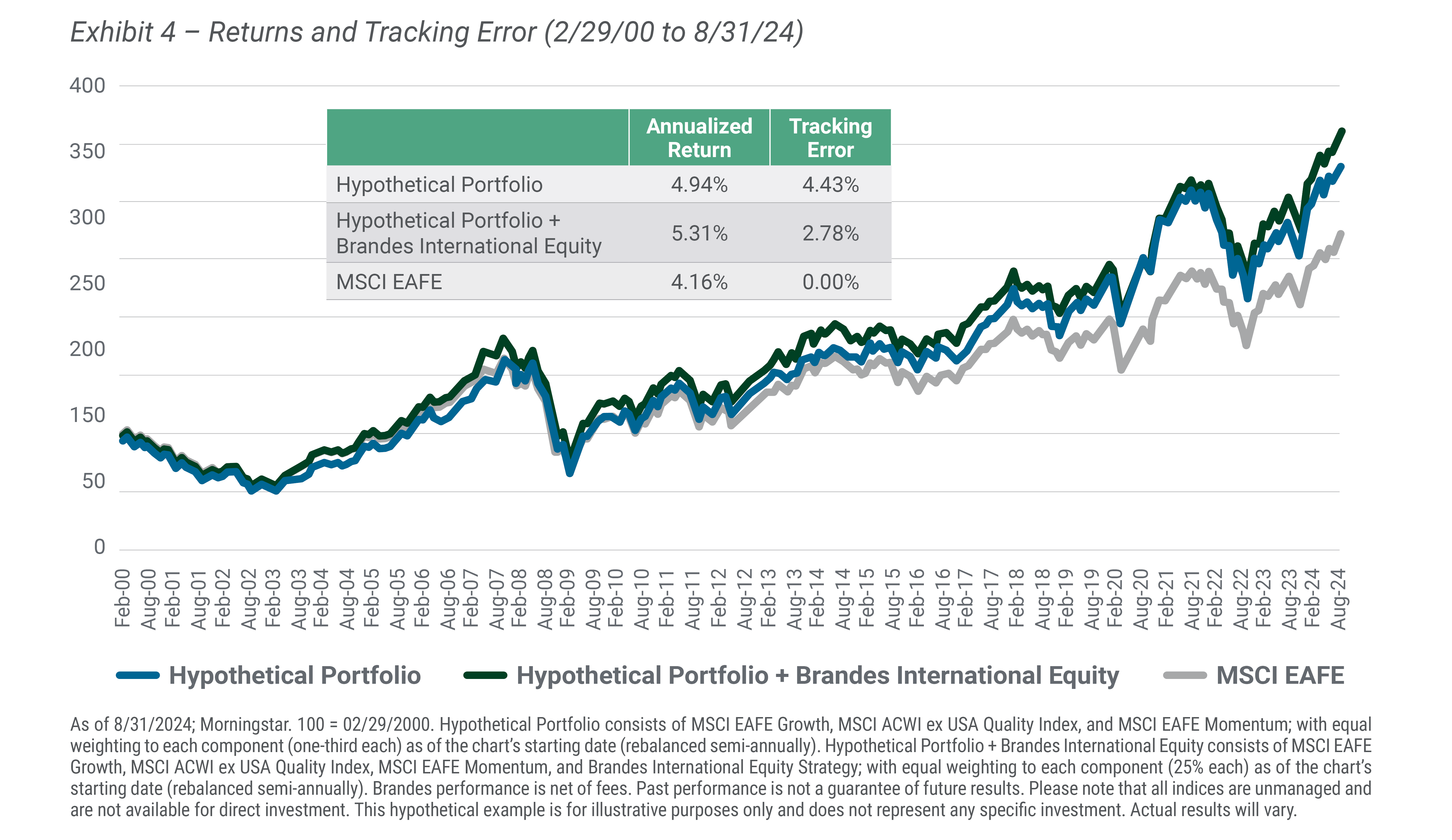

During the “long winter” for the value investment style—from 12/31/06 to 9/30/20, which marked the longest and largest underperformance of MSCI EAFE Value relative to MSCI EAFE Growth since their inception—many investors decided to abandon value due to its disappointing performance. While having value exposure (represented by Brandes International Equity) over this particular period did diminish the hypothetical portfolio’s returns (see Exhibit 2), maintaining a consistent value exposure over the long term helped enhance returns and reduce tracking error (see Exhibit 4).

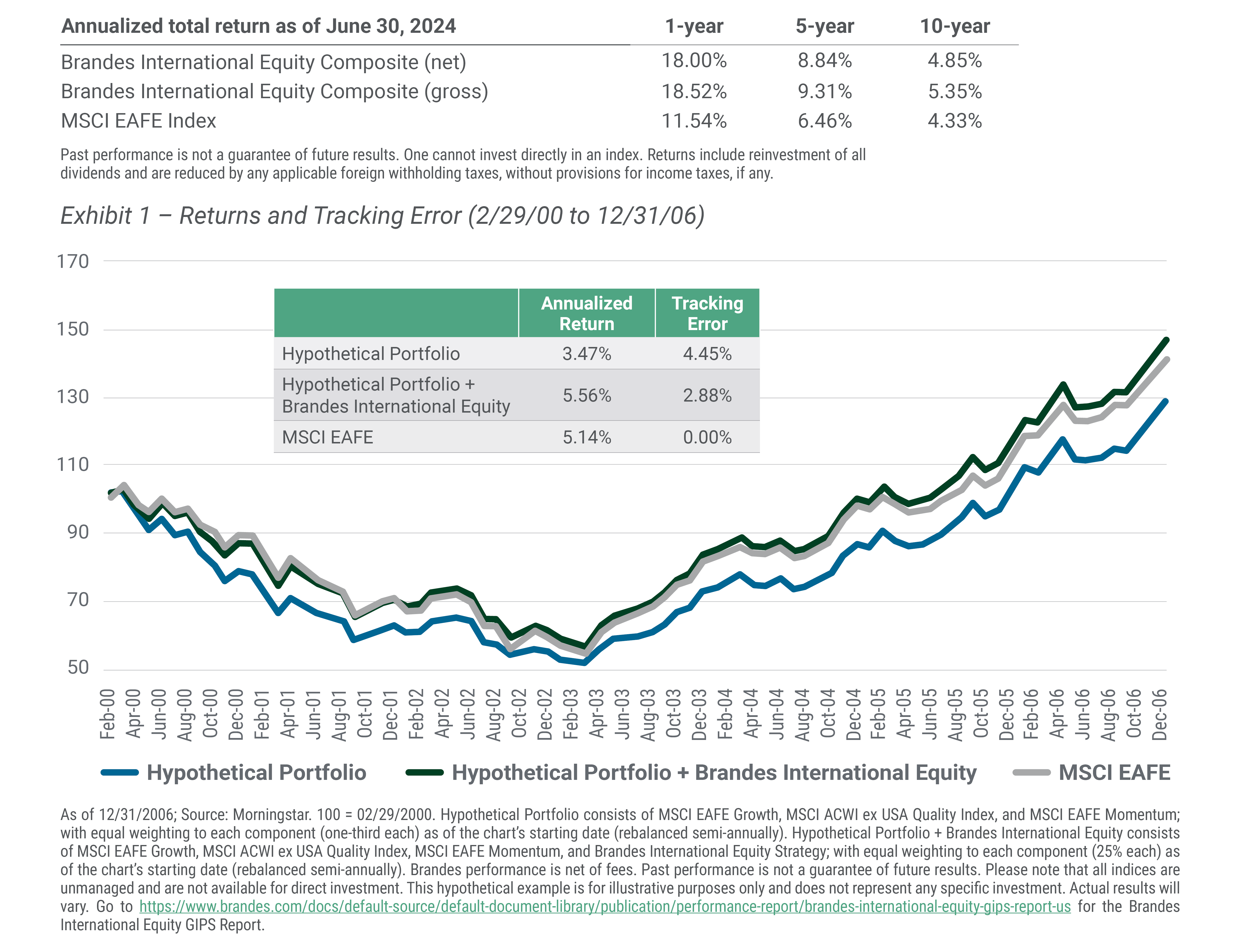

After a period of largely ignoring valuations, especially for tech-related businesses, investors started paying attention again to company fundamentals post-tech bubble, prompting a value-led cycle (MSCI EAFE Value vs. MSCI EAFE Growth) that lasted nearly seven years. Adding the Brandes International Equity Strategy to the hypothetical diversified portfolio would have enhanced return, while reducing tracking error.

The low-growth economic environment, growing popularity of index investing, and easy money made available by central banks worldwide led to a willingness among investors to “pay up” for any growth potential. Amid the long winter for value, many investors reduced their value allocations, and some traditional “value” managers allowed their investing styles to drift in hopes of improving short-term performance and asset gathering. The valuation gap between value and growth widened to historical highs across various metrics (e.g., price/book, price/earnings, price/cash flows, enterprise value/earnings before interest, taxes, depreciation and amortization), and many wondered about the “death of value investing.”

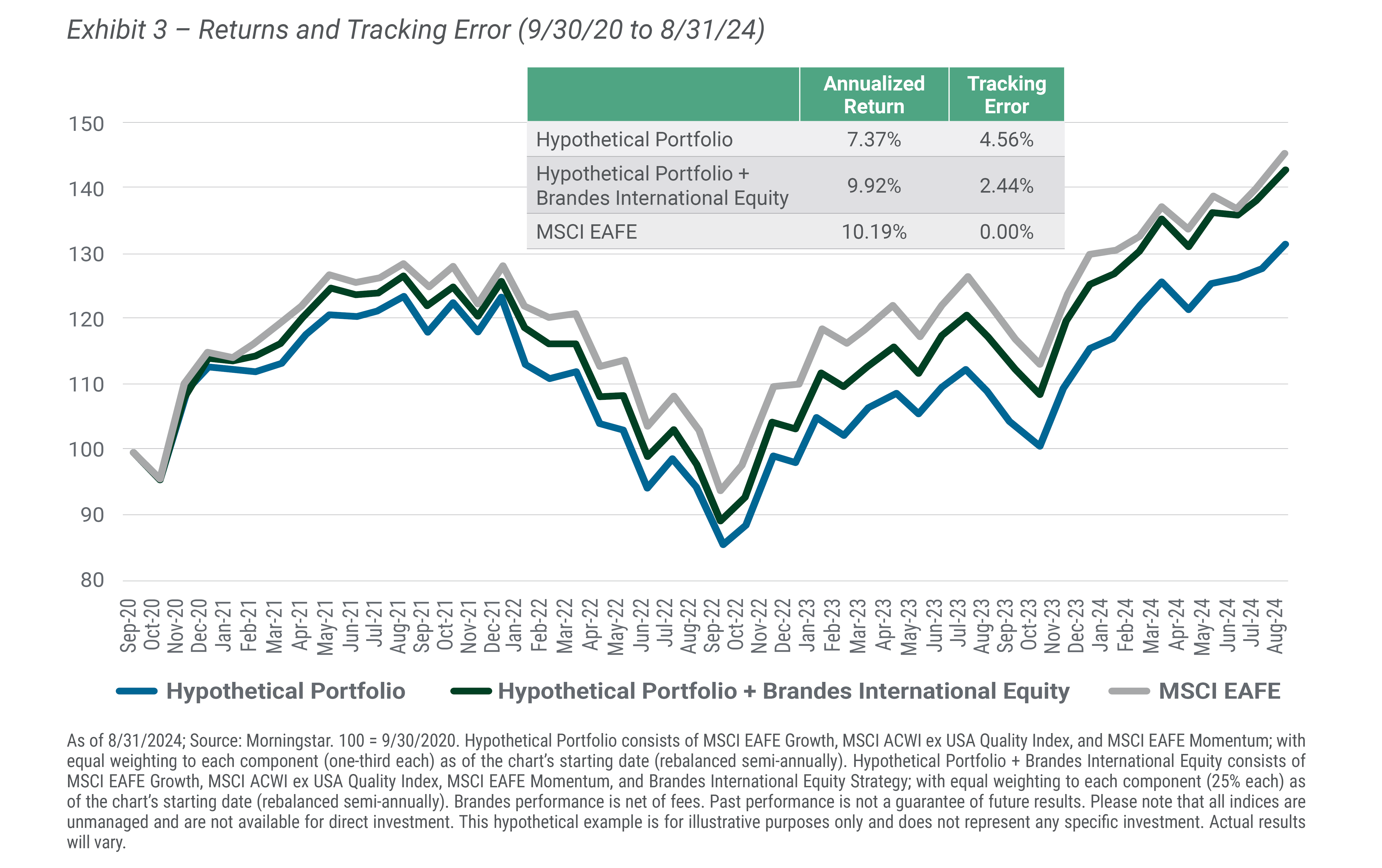

After being out of favor for more than a decade, value stocks made a remarkable comeback in the fourth quarter of 2020, driven by optimism about post-COVID economic recovery, rising inflation, and higher interest rates. Although the recovery of value stocks has not been linear, with bouts of growth outperformance during the cycle, incorporating the Brandes International Equity Strategy into the hypothetical diversified portfolio could have generated higher return and lower tracking error. It is important to note that even after value’s outperformance, the valuation discount for value stocks relative to growth remains historically high across various metrics.

Despite the long value winter accounting for over half of the past 25 years, having value exposure was beneficial to both risk and return of a diversified portfolio across the three periods discussed above (see Exhibit 4).

We do not know when a style cycle will turn or what the next catalyst for the shift in style leadership will be. However, we believe incorporating value exposure—especially through a partnership with a manager such as Brandes that has maintained a consistent approach to value—may benefit a diversified portfolio from a long-term risk and return perspective.

Thank you,

Brandes Investment Partners